Discover visa options for accountants in Australia, TPB registration, CPA/CA recognition, Big 4 & corporate tax jobs, and average salaries. Complete 2025 guide for overseas tax accountants planning skilled migration.

Introduction

Australia remains one of the top destinations for taxation accountants seeking higher salaries and long-term career growth. With “Accountant (General)” ANZSCO 221113 still on the skilled occupation list and strong demand from the Big 4, mid-tier firms, and industry, thousands of overseas tax professionals successfully migrate each year. This guide covers every step: visa pathways, credential recognition, and current job prospects.

Why Australia Needs Taxation Accountants

Australia’s complex tax system, frequent legislative changes, and growing emphasis on transfer pricing and international tax create constant demand for qualified taxation specialists. The Australian Tax Office (ATO), Deloitte, PwC, EY, KPMG, and hundreds of mid-tier and boutique firms actively recruit both locally and overseas. Roles range from graduate tax consultant to tax manager and partner-level positions, with many offering employer-sponsored visas.

Skilled Migration Pathways for Tax Accountants

Several visa options for accountants in Australia remain open in 2025:

– Subclass 190 (State-Nominated Permanent Residency) – requires state nomination (NSW, Victoria, South Australia, and Tasmania regularly nominate accountants).

– Subclass 491 (Regional Provisional) – 15-point boost and access to regional tax accountant jobs in Australia.

– Subclass 482 TSS (Medium-Term stream) – popular employer-sponsored visa for tax accountants; leads to permanent residency after three years.

– Global Talent Visa (GTI) – fast-tracked independent visa for senior tax specialists earning above the high-income threshold (currently AUD 197,050).

The occupation “Accountant (General)” ANZSCO 221113 appears on the Core Skills Occupation List (CSOL), keeping it eligible for points-tested and sponsored pathways.

Getting Your Qualifications Recognised in Australia

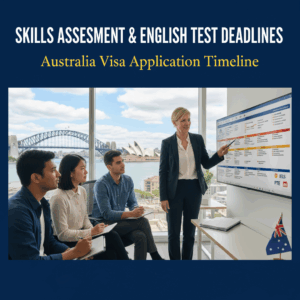

Overseas accounting qualifications need assessment before you can apply for skilled migration or professional membership.

1. Skills Assessment

Most tax accountants choose CPA Australia or CA ANZ for their CPA migration assessment. Both bodies assess tertiary qualifications and relevant experience against Australian standards.

2. Professional Membership

To work as a tax agent in Australia, you must register with the Tax Practitioners Board (TPB). Pathways include:

– Full CPA Australia membership or CA ANZ membership → automatic eligibility for Tax Agent registration

– Institute of Public Accountants (IPA) membership → also recognised

– Direct TPB application with an Australian Bachelor/Master degree in accounting + relevant units

3. BAS Agent Registration

Many tax accountants also register as BAS agents to lodge GST and PAYG statements — a requirement for most public practice roles.

Job Market and Salary Expectations in 2025

Tax accountant jobs in Australia remain strong, especially in Sydney, Melbourne, Brisbane, and Perth.

– Big 4 tax roles (Deloitte, PwC, EY, KPMG): $75,000–$110,000 starting (graduate to senior consultant); tax manager $160,000–$220,000+

– Mid-tier accounting firms: $80,000–$140,000 for 3–8 years’ experience

– Corporate tax jobs (in-house): $120,000–$180,000 + bonus

– Australian Tax Office (ATO) jobs: APS5–EL2 roles from $85,000 to $160,000+ with excellent work-life balance

– Remote tax accounting roles are increasing, especially for regional 491 visa holders.

Experienced international tax, transfer pricing, and R&D tax specialists command premium packages and frequent sponsorship.

Next Steps to Start Your Journey

Begin with a skills assessment from CPA Australia or CA ANZ, lodge an Expression of Interest (EOI) for 190/491 visas, and target employers who regularly sponsor (Big 4 and many mid-tier firms list 482 sponsorship on their careers pages). Early preparation gives you the best chance of success.