Discover Australia’s strongest state economies in 2025, from WA’s mining dominance to QLD’s surge. Explore unemployment rates, growth forecasts, and in-demand jobs to guide career and migration decisions.

Introduction

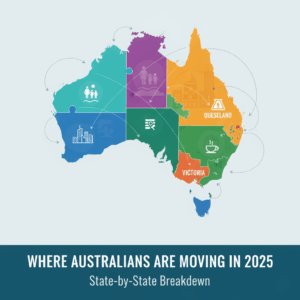

Australia’s economy in 2025 demonstrates resilience amid global uncertainties, with GDP growth projected at 1.6% nationally. Yet, performance varies sharply by state, driven by resources booms, population influxes, and sector-specific investments. Western Australia leads as the top performer for the fifth straight quarter, per CommSec’s State of the States report, fueled by mining and low unemployment. This state-by-state comparison analyzes economic growth by Australian state 2025, unemployment rates, and state economic performance Australia 2025. For skilled migrants and job seekers, understanding these trends reveals opportunities in the Australian employment outlook 2025, including regional migration occupations Australia and skilled migration priority occupations 2025. Whether targeting NSW in-demand jobs 2025 or Tasmania renewable energy jobs 2025, aligning skills with these hotspots can accelerate career growth and visa pathways.

Australia’s Economic Landscape in 2025

Australia’s national economy enters 2025 on solid footing, with the unemployment rate holding steady at 4.3% through October, according to the Australian Bureau of Statistics. Labour force participation reaches a record 67.0%, reflecting robust job creation despite moderating GDP growth. The Jobs and Skills Australia report 2025 highlights that service industries drove nearly 90% of employment growth over the past decade, underscoring a shift toward knowledge-based roles. Key challenges include persistent Australian skills shortage 2025 in critical areas like healthcare and engineering, alongside inflationary pressures easing to support consumer spending.

Economic momentum favors resource-rich states, as outlined in CommSec’s October 2025 analysis. Eight indicators—economic growth, retail spending, equipment investment, unemployment, construction, population growth, housing finance, and dwelling starts—reveal WA topping five metrics. Nationally, state final demand rose 1.2% in the September quarter, per ABS data, with private consumption and dwelling investment leading gains. For migrants, this translates to priority under the Core Skills Occupation List (CSOL) 2025 and National Skills Priority List 2025, emphasizing roles in high-demand sectors.

Yet, disparities persist. Mortgage-sensitive economies like NSW and Victoria lag due to higher borrowing costs, while QLD’s climb to second spot signals recovery. The IPA’s State Economic Scorecard 2025 ranks QLD highest overall, citing low debt and energy prices, though Victoria trails with high taxes. These trends inform the state-by-state job market Australia 2025, where fastest growing jobs Australia 2025 cluster around renewables, tech, and aged care. Job seekers should monitor the 482 visa in-demand occupations and 494 regional visa jobs list for tailored opportunities.

This overview sets the stage for a deeper dive into each state’s performance, highlighting implications for workforce planning and migration.

Western Australia: Resource Powerhouse Leads the Pack

Western Australia claims the strongest state economy Australia 2025, leading CommSec rankings for five consecutive quarters. Its economy outperforms on retail spending, unemployment (4.1%), population growth, housing finance, and dwelling starts. Despite modest quarterly growth of 1.0%, annual momentum accelerates, propelled by mining exports and interstate migration. The WA resources sector jobs 2025 boom, with iron ore and LNG driving 17.1% of national output.

Unemployment at 4.1%—lowest nationally—signals a tight labour market, per ABS October data. In-demand roles center on engineering shortages Australia 2025, particularly in mining and renewables. Western Australia mining jobs 2025 dominate, with power system engineers earning up to $200,000. The Jobs and Skills Australia report 2025 notes 14.2% growth in cybersecurity jobs Australia 2025, vital for resource tech integration.

For migrants, WA prioritizes skilled workers via state nomination, aligning with CSOL 2025. Regional roles in Pilbara offer pathways under the 494 visa. Construction jobs boom Australia 2025 supports infrastructure, adding 95,000 national roles by 2030. Job seekers with trades qualifications thrive here, as VET completion boosts outcomes by 35% in five years.

WA’s edge stems from commodity prices and population gains of 2.5% annually. However, diversification into renewables—projected to add 21,400 jobs—mitigates mining volatility. This blend positions WA as a magnet for highest paying jobs Australia 2025, averaging $160,000 in engineering.

Queensland: Rising Momentum in a Resources Hotspot

Queensland surges to second in CommSec’s 2025 rankings, up from third, with strong economic momentum rivaling WA. State final demand grew 1.5% in September, outpacing the national 1.2%. Unemployment dips to 4.2%, supporting robust retail and construction activity. The IPA scorecard crowns QLD the best performer, thanks to low debt and energy affordability.

The Queensland skills shortage 2025 intensifies in tourism and agriculture, per OSL data, with 29% of occupations nationally short. Fastest growing jobs Australia 2025 here include renewable energy technicians, tied to grid expansions. Healthcare jobs Australia 2025, like nurses, face acute demand amid NDIS jobs growth 2025. Average salaries hit $90,000–$140,000 in tech, drawing 482 visa applicants.

Migration shines via regional programs; 21 occupations shortage exclusively in rural QLD, per JSA. The 494 regional visa jobs list favors trades, with construction adding 283,000 roles nationally by 2030. Brisbane’s tech hub boosts data scientist and AI jobs Australia, projecting 22% growth.

QLD’s 19.1% national output share relies on coal and gas, but diversification into solar—creating 585,000 jobs by 2034—builds resilience. Job postings double pre-pandemic levels, per Indeed, signaling opportunity. For career changers, VET in renewables yields quick entry, with 72% alignment to roles.

South Australia: Steady Growth Amid Defence Surge

South Australia secures third, with 8.7% economic growth in June—topping CommSec’s metric—driven by domestic spending. Unemployment at 4.3% reflects stability, though fill rates for Skill Level 3 jobs lag at 55.5%. State final demand rose 1.0%, buoyed by housing and retail.

The South Australia defence jobs 2025 boom, via AUKUS, creates engineering demand; shortages persist in 139 occupations since 2021. Aged care workforce shortage Australia intensifies, with allied health on CSOL 2025. Salaries average $108,000 for professionals, per ABS.

State nomination prioritizes regional migration occupations Australia, with 3.6% annual demand growth outpacing national 2.6%. Teaching and education jobs 2025 Australia grow 72,000 nationally, favoring SA’s vocational focus. Job postings near double pre-pandemic, per Indeed.

SA’s low tax burden and wages growth lead IPA rankings, but energy prices challenge. Renewables add momentum, projecting 14% cyber growth. Migrants with VET in defence secure PR via 190 visas, leveraging 86% full-time roles.

Victoria: Construction Rebound Lifts Rankings

Victoria climbs to fourth, leapfrogging rivals via construction leadership. Unemployment at 4.7%—highest nationally—masks recovery, with state demand up 1.3%. CommSec notes solid retail and migration inflows.

Victoria fastest growing occupations 2025 span health and tech; nurses and data scientists top shortages. Construction jobs boom Australia 2025 adds 95,000 roles, with electricians earning $75,000–$100,000. The OSL flags 29 new shortages in trades.

State sponsorship targets Melbourne’s hubs, aligning with 482 visa in-demand occupations. AI roles project 22% growth, per JSA. Job postings up 33% from pre-pandemic, though 46% off peak.

Victoria’s 22.7% output share hinges on manufacturing revival, but high debt drags IPA rank. Infrastructure investments, like Big Build, create 145,000 professional jobs by 2030. Upskilling via postgraduate engineering boosts earnings 35%.

New South Wales: Mortgage Pressures Temper Strength

NSW ties for fifth, leading economic growth but hampered by 4.3% unemployment and borrowing costs. Demand rose 1.4%, per ABS, with housing finance rebounding.

NSW in-demand jobs 2025 focus on finance and IT; cybersecurity shortages hit 18% growth. Highest paying jobs Australia 2025 average $190,000 for architects in Sydney. The report notes 90% post-secondary need for top roles.

Migration via 190 visas favors Sydney’s tech, with 236,000 new jobs by 2030. Regional shortages in aged care offer 494 pathways. Postings up 40% from baseline, per Indeed.

NSW’s 30.7% output dominance faces productivity stalls, but tax cuts aid recovery. Green jobs in renewables project 585,000 additions.

Tasmania: Renewables and Equipment Investment Shine

Tasmania holds sixth, leading equipment spending amid -2.9% demand dip. Unemployment at 3.9%—strongest—supports tourism recovery.

Tasmania renewable energy jobs 2025 surge, with green tech shortages. Education roles grow, per JSA. Salaries hit $170,000 for engineers.

State nomination prioritizes hydro projects; 1.6% output share belies 9% employment growth forecast. Low rentals aid IPA second rank.

Battery and wind investments create trades demand, aligning with CSOL 2025.

Australian Capital Territory: Tech and Public Service Anchor

ACT ranks seventh, with 4.5% unemployment and public sector dominance. Demand fell -1.1%, but 9.2% growth projected.

ACT public service and tech jobs 2025 lead; software engineers top lists. Cyber roles grow 14.2%.

Federal focus yields stable hires; 190 visas favor IT. Postings steady, with AI demand at 22%.

Northern Territory: Momentum from Resources and Tourism

NT jumps to fourth, with 5.2% unemployment but fastest momentum. Demand up 0.9%, led by equipment.

Northern Territory critical occupations 2025 include mining; LNG drives shortages. Salaries $160,000+.

Regional visas boost migration; tourism adds hospitality roles.

Conclusion

In 2025, Australia’s strongest economies cluster around resources and diversification, with WA, QLD, and SA leading on growth and jobs. Key takeaways: Target states matching your skills—WA for mining, VIC for construction—to navigate Australian labour market trends 2025. The Jobs and Skills Australia report 2025 urges alignment via training; migrants, leverage CSOL 2025 for priority. Assess your fit today: Review state lists, upskill in shortages, and consult migration experts to secure your foothold in this dynamic landscape.